montana sales tax rate 2019

3100 1 of taxable income. Montana Department of Revenue Gene Walborn Steve Bullock.

Taxes Fees Montana Department Of Revenue

The Bozeman sales tax rate is.

. Click here for a larger sales tax map or here for a sales tax table. Tax rates last updated in April 2022. 2019 Montana Individual Income Tax Rates.

Montana MT Sales Tax Rates by City. There is no local add-on tax. The combined sale tax rate is 0.

For single taxpayers living and working in the state of Montana. By City and Industry. Montanas sales tax rates for commonly exempted categories are listed below.

At that time Montana legislators had proposed bills to lower tax rates and to offer tax credits and deductions. The tax year 2018 sales assessment ratio of class 4 commercial and industrial property is. Get a quick rate range.

The Missoula sales tax rate is NA. Montana Individual Income Tax. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

Method to calculate Montana sales tax in 2021. Sales tax region name. The 2018 United States Supreme Court decision in South Dakota v.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. But not more than Then your tax rate is.

368 rows There are a total of 73 local tax jurisdictions across the state collecting an average local tax of 0002. 11100 4 of taxable income. 2020 rates included for use while preparing your income tax deduction.

Table 2Effective Property Tax RatesResidential Property. There is 0 additional tax districts that applies to some areas geographically within Missoula. Sales and Use Tax 2019 Statistics.

5400 2 of taxable income. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a states tax system. Montana state sales tax rate.

There are additional taxes on tourism-related businesses such as hotels and campgrounds 7. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The revised tax year 2019 taxable percentage rate for class 12 property is estimated to be 320.

Combined with the state sales tax the highest sales tax rate in Montana is 5 in the cities of Sidney Fairview Westby and Biddle. If the long-term consequence of sales tax holidays is a higher sales tax rate. Montana is one of the five states in the USA that have no state sales tax.

2022 Montana Sales Tax Table. The motor vehicle sales tax amounts are not included. Last updated April 2022.

Tax rate of 2 on taxable income between 3301 and 5800. Montana ranks relatively high on its use of. 2019 Sales Taxes Montana has no general sales tax but levies selective excise taxes on gasoline alcohol tobacco lodgings and other items.

The latest sales tax rates for cities in Montana MT state. Rates include state county and city taxes. If these bills were passed unchanged they could have jeopardized Montanas ARPA funding.

Tax rate of 6 on taxable income between 14301. Avalara provides supported pre-built integration. While the base rate applies statewide its only a starting point for calculating sales tax in Montana.

ARPA was passed while the 67th Montana Legislature was in session. Start managing your sales tax today. Did South Dakota v.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Effective tax rates are property taxes divid- ed by the market value of the property. By Justin Fontaine July 26 2019.

In reviewing the history of a sales tax in other states the rate has continually been adjusted upward as infrastructure costs increase. TAX RATES Chargeable Income From To Rate Subtract. Wayfair Inc affect Montana.

Automate sales tax calculations reporting and filing today to save time and reduce errors. Lawmakers must understand that they cannot resolve the unfairness of sales taxes simply by offering a short break from paying these taxes. The County sales tax rate is.

The minimum combined 2022 sales tax rate for Bozeman Montana is. Tax rate of 1 on the first 3300 of taxable income. The Montana MT state sales tax rate is currently 0.

This is the total of state county and city sales tax rates. Montana is one of the five states that have no sales tax. The Montana sales tax rate is currently.

Per 15-6-145 MCA the Department of Revenue shall calculate the taxable percentage rate for. We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the highest MT tax rate bracket of 675. The sales and use tax amounts include the 6875 general rate sales and use 4469 mobile home 65 in-lieu lottery additional 25 liquor and additional 92 car rental taxes.

For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. If your taxable income Form 2 page 1 line 14 is.

Some rates might be different in Montana State. Start a trial Contact sales. The state sales tax rate in Montana is 0 but you can.

Base state sales tax rate 0. The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State. 8200 3 of taxable income.

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

How Do State And Local Sales Taxes Work Tax Policy Center

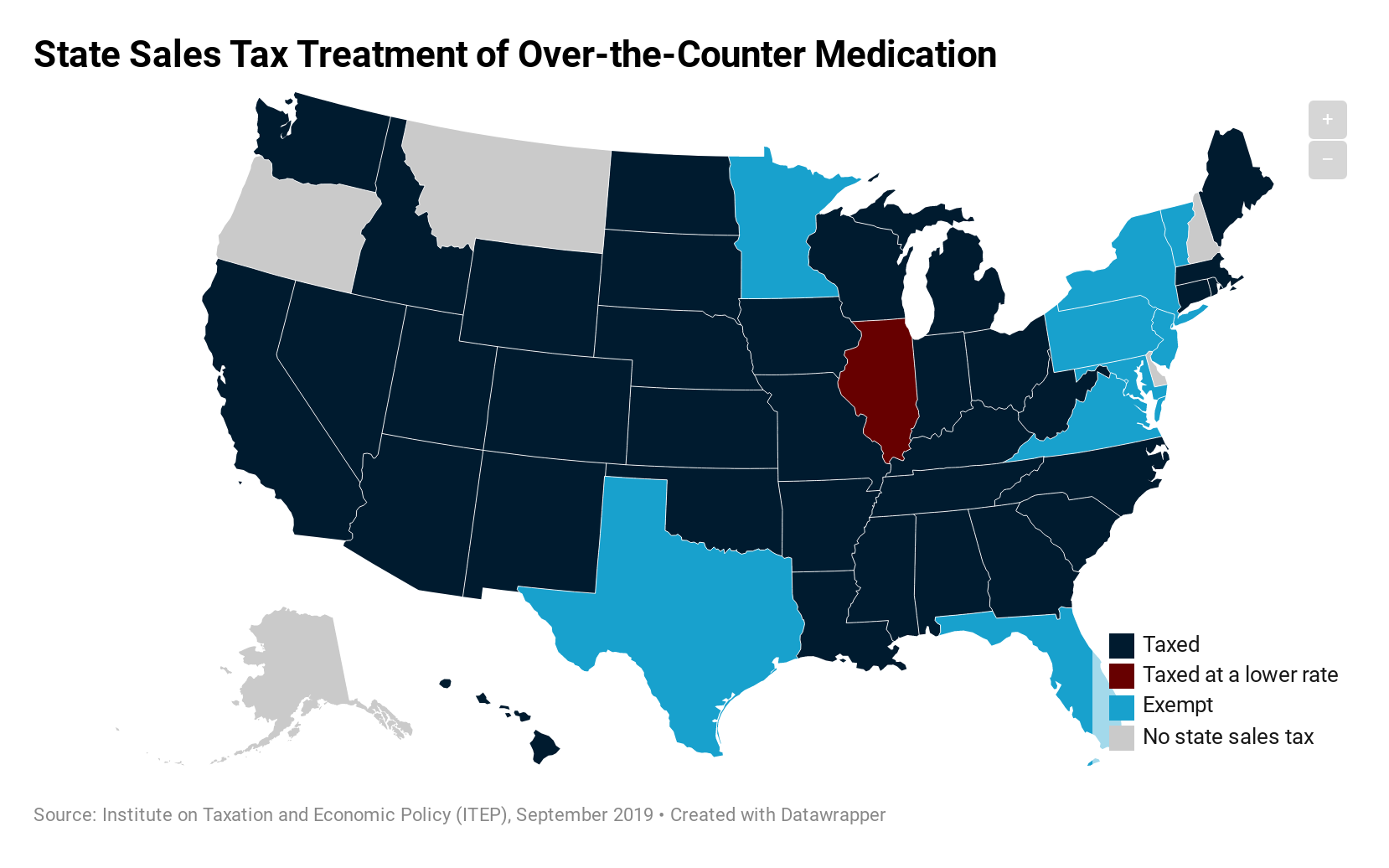

How Do State Tax Sales Of Over The Counter Medication Itep

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

States With Highest And Lowest Sales Tax Rates

States Without Sales Tax Article

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

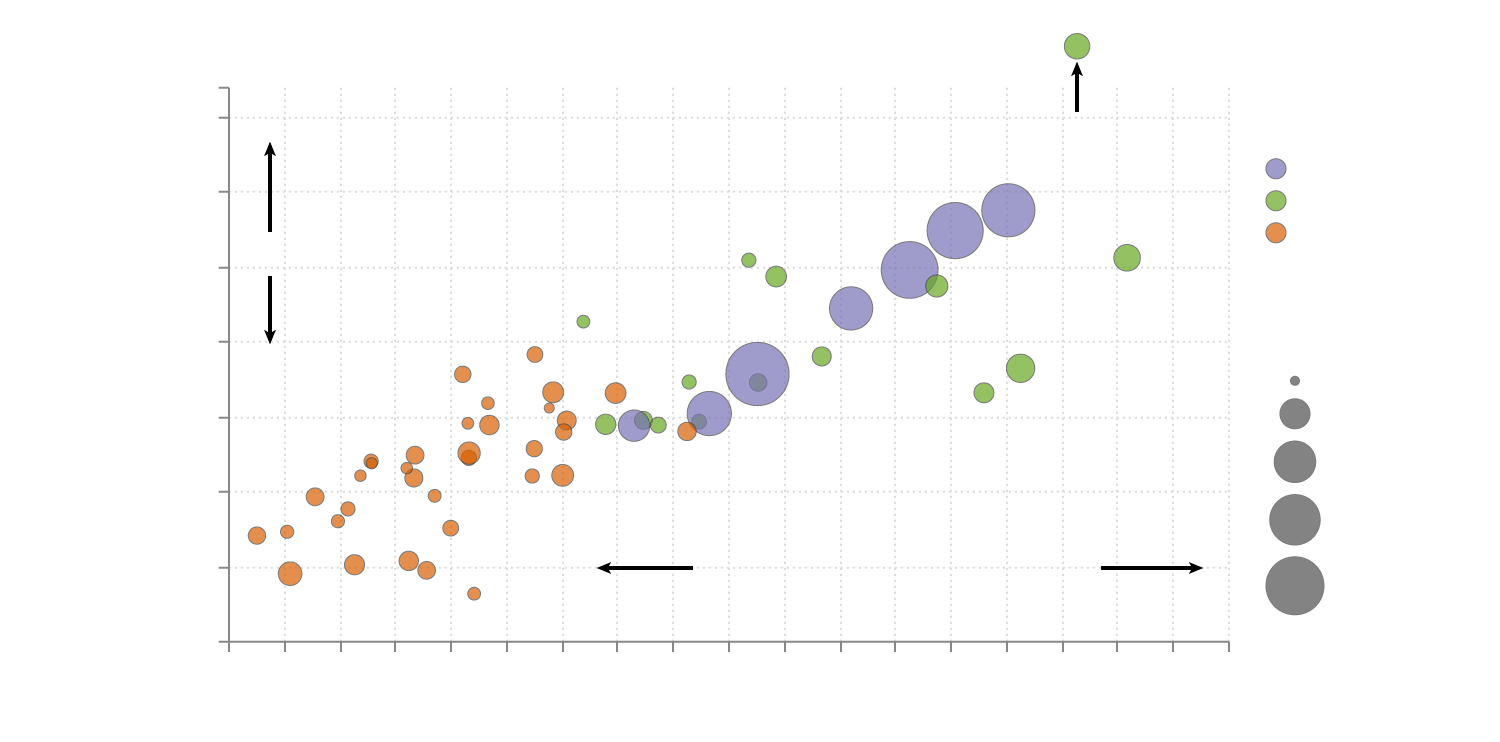

Who Pays Taxes In America In 2019 Itep

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

State Corporate Income Tax Rates And Brackets Tax Foundation

Salestaxhandbook The Comprehensive Sales Tax Guide

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Sales Tax Definition What Is A Sales Tax Tax Edu